$90 A Paradigm Shift in Building the Financial Case for High Performance Homes. $90,000,000 reasons that building giant, DR Horton should consider a national commitment to build HERS Rated homes (having a target to build homes that perform 40% better than code) Ten years ago this month, March 2008, I was introduced to the concept of a high-performance home. At this point in my career, I was an expert in custom financing, having closed over $1B in career personal production; but had no idea what a HERS Rating was. I had no idea how to improve the energy performance of a home and I had no idea how to improve the indoor air quality of a home. I was perfectly comfortable running my mortgage lending business being focused on the traditional criteria that all lenders use … the purchase price of a home, the loan amount needed, the interest rate, the down payment and the monthly mortgage payment. Ten years has changed my entire business world and today, I carefully look at the energy performance of a home, I have become a student seeking to learn all that I can about indoor air quality and I pay special attention to our collective impact on the environment. The overriding focus of my business has also changed to one that is based on helping my clients develop strategies which minimize the Total Cost of Ownership (TCO) of their new home, including the development of a proprietary software program that makes the TCO model scalable and able to support a national team of mortgage lenders and their business partners. So what does this have to do with a large successful publicly owned home building company like DR Horton? Everything actually … it’s called Enhanced Shareholder Value. Today, there are a number of forces that drive large home builders to make decisions on how to build their homes. Some of the forces are financial, some are based on the expertise of the leadership team, some are based on brand awareness/product appeal to specific market segments, some are based on strategic decisions made years ago that drove specific raw land / lot purchases and some are based on the culture of the company itself. Regardless of the specific forces that ultimately shape each builders’ business, there is one thing that all publicly owned home builders have in common … they are all charged with a focus on making money for their shareholders … aka - enhancing shareholder value. This article may just blow your mind on how a company like DR Horton can adopt a high performance home strategy to do just that ... perhaps a little financial innovation will help. Before I dive in to a bunch of fancy solutions with pretty graphs, let’s get real about the challenges that may be impacting why a company like DR Horton may not already be building homes that perform 40% better than code …

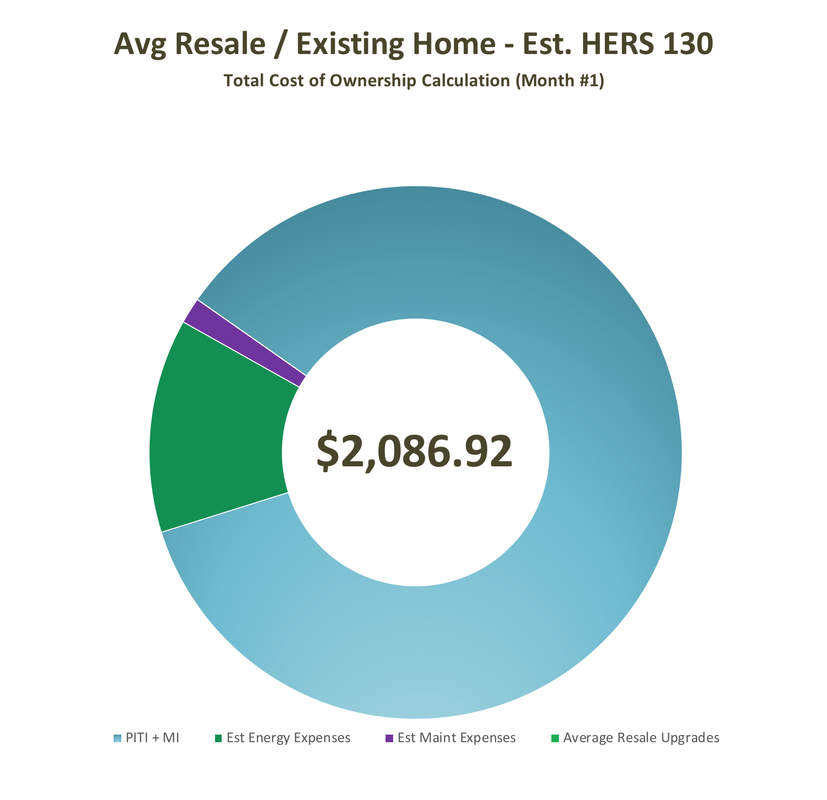

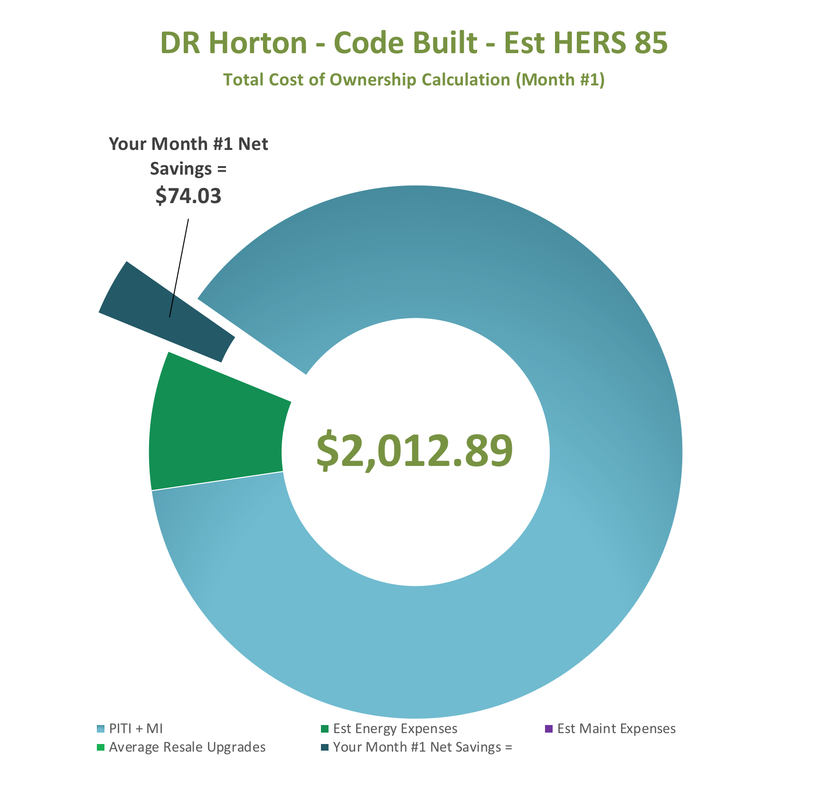

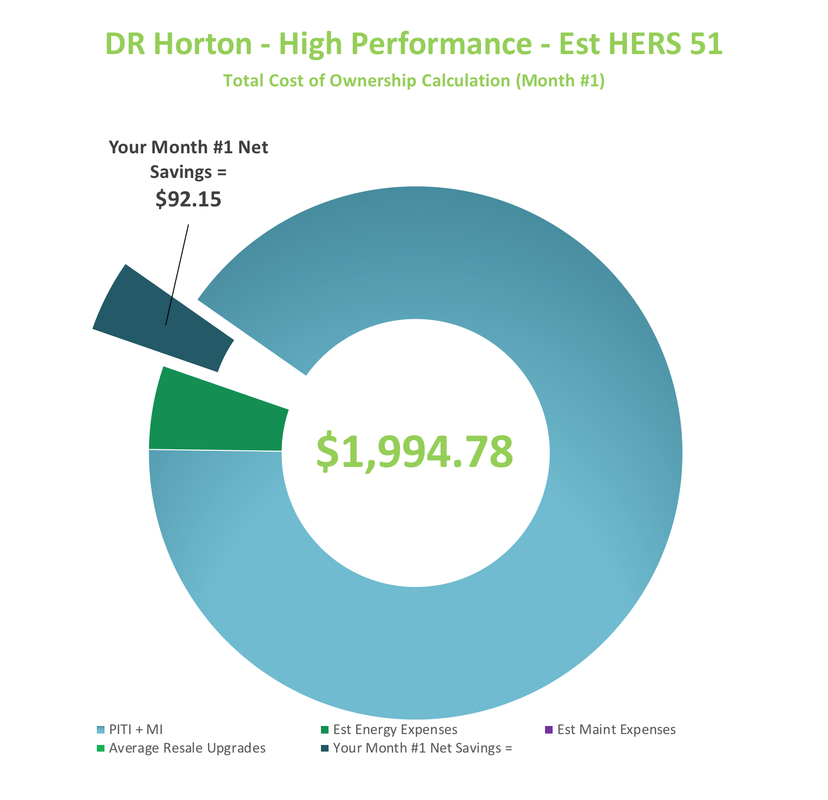

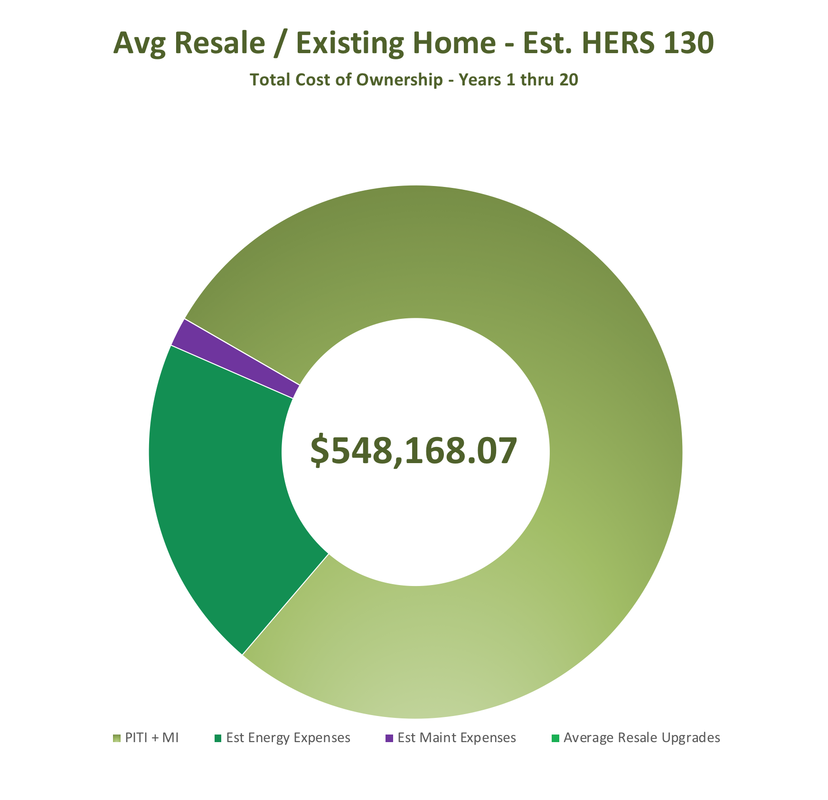

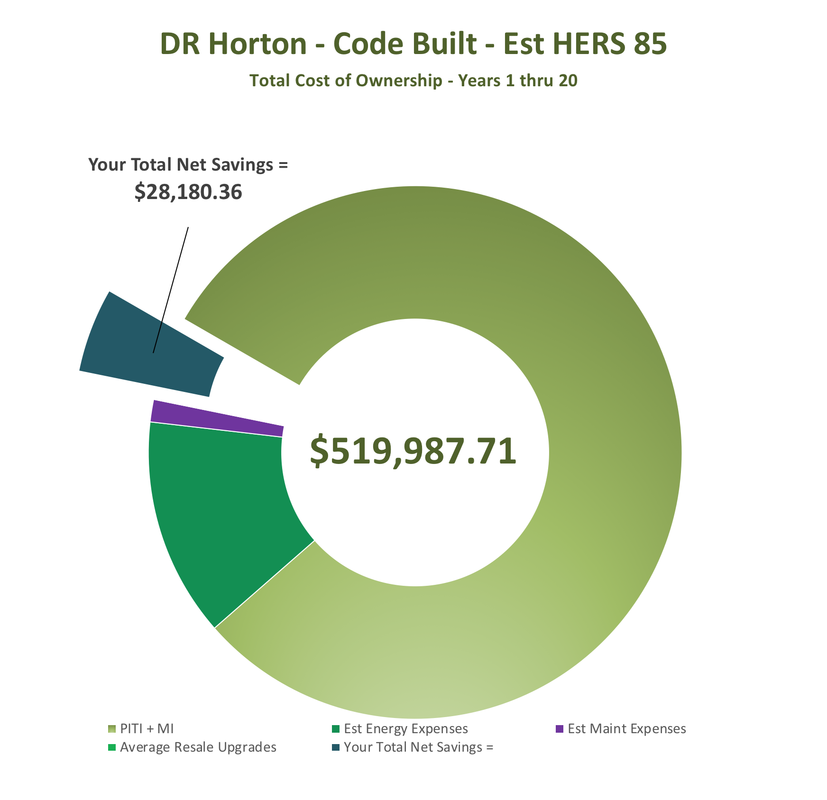

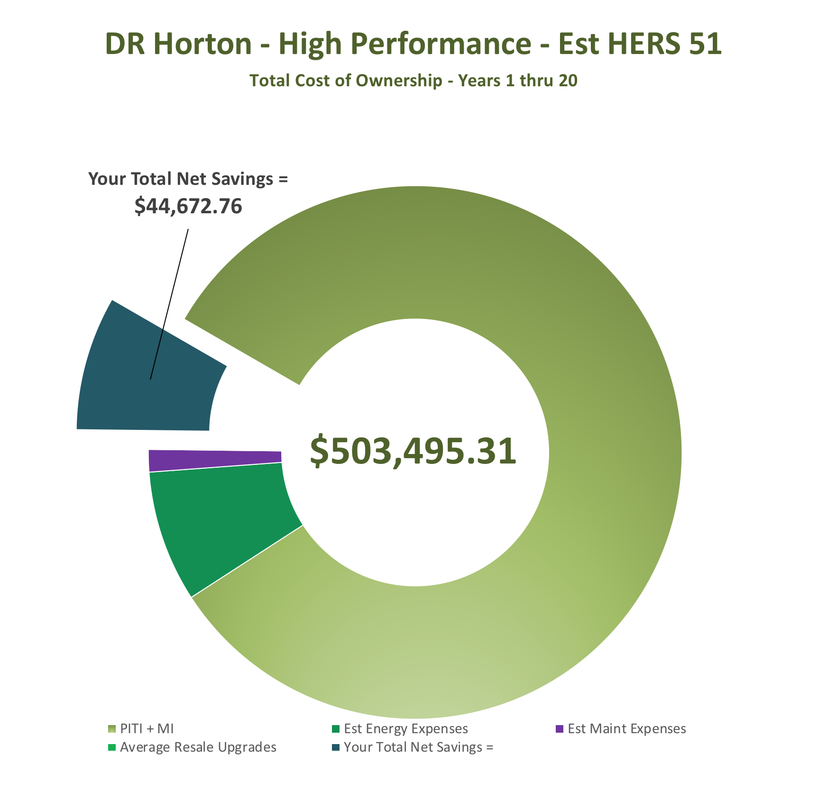

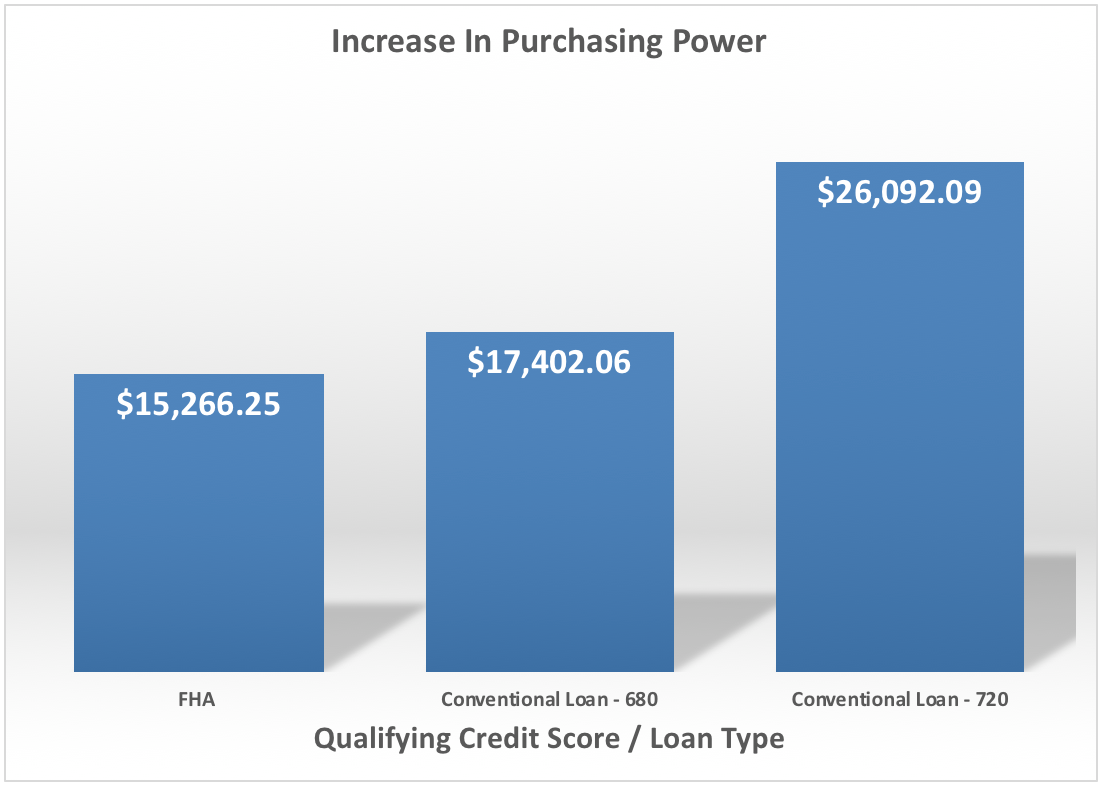

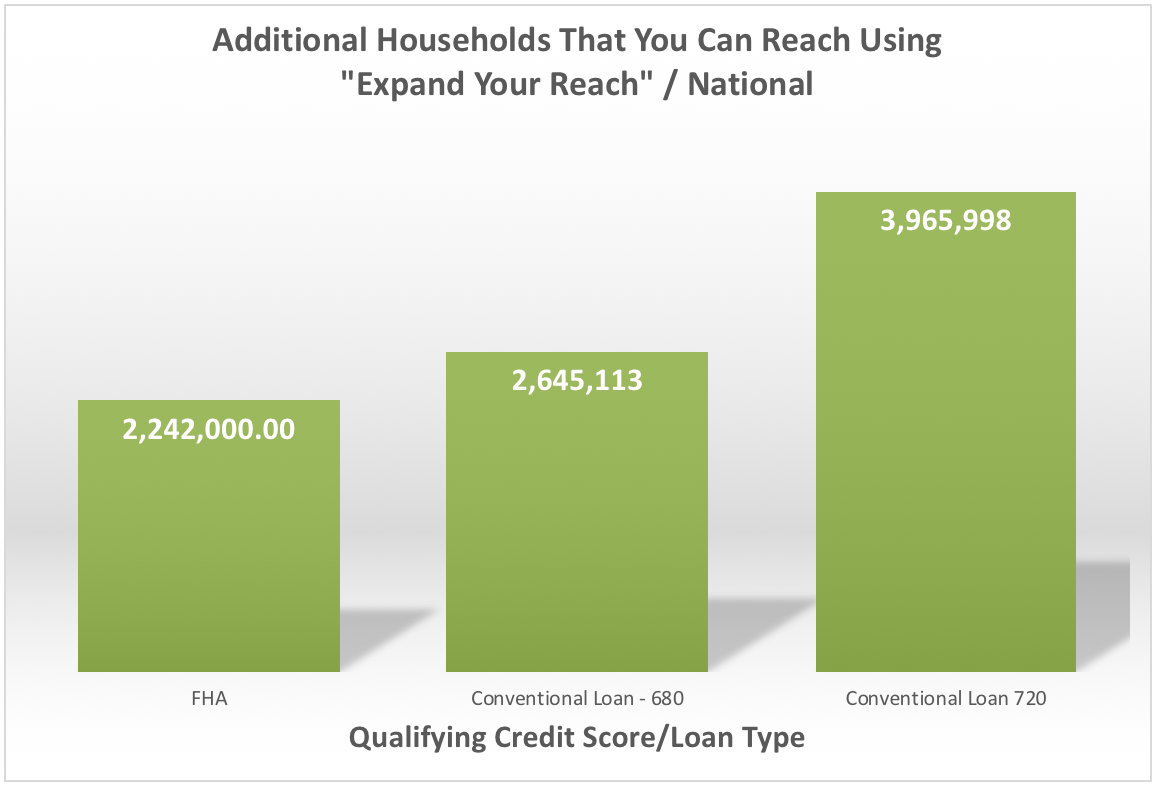

By now, you may be thinking that this guy is totally crazy for even beginning to write this article … I mean, this is all bad stuff … and none of it has anything to do with enhancing shareholder value (or running a successful company for that matter). I know, I know … hang in there just a minute, here comes the good stuff … Let’s address these challenges one by one … Challenge #1 - They cost more to build and need to be sold at a higher price Yes, high-performance homes do typically cost more to build and in turn, typically sell for more … but they also cost less to own. The purchase price of a home is one transaction on one day … the total cost of owning a home (or TCO) is a series of transactions that last for a lifetime. So, to address this challenge, we develop financial models to compare the TCO of your current homes to the TCO of a high-performance version of your same home (including optimized mortgage terms) … we look at the down payment, we look at the initial monthly payments and we look the long term total payments … and frankly, the numbers will amaze you.. Check this out ... The first three images below reflect the Month #1 Total Cost of Ownership for three hypothetical homes, (a) an existing home priced at $275,000 (w/estimated HERS 130), (b) a hypothetical "code built" DR Horton home with a sales price of $285,000 (w/estimated HERS Rating 85), and finally, (c) a hypothetical "high-performance" DR Horton home with a sales price of $295,000 (w/estimated HERS Rating of 51 (so est. $10,000 increase to reflect the cost of building a home with a 40% lower HERS). Pretty amazing that in Month #1, (not 8 or 9 years to breakeven) the most expensive home of the three, the DR Horton HERS 51 home, has a Total Cost of Ownership that is $92 less. The second set of three images reflect the same three homes, but here, we are showing the Total Cost of Ownership using a 20 year ownership period. And once again, the highest priced home, the HERS 51 DR Horton home has the lowest TCO, generating a net savings of over $44,000 (the savings add up to over $100,000 at the end of a 30 year mortgage). Pretty amazing, huh? Challenge #2 - You may reduce the number of buyers who will qualify for a loan to purchase your home Using traditionally structured financing, this statement is 100% right … but when combining your high-performance home with a TCO designed financing package (featuring optimized mortgage terms), we can expand the number of households that you can sell to. We can typically see an increase in the qualifying amount for an average FHA buyer approx. 5% … and for a conventional buyer with 10% down, the increase in qualifying dollars is usually in the 6-8% range. So, yes, we can address this challenge. Below are two graphs based on data from the 2016 NAHB "Priced Out" report that have been analyzed by the "Expand Your Reach" module of the TCO software. The first graphic reflects the impact on the "purchasing power" of buyers who apply for either an FHA or Conventional 1st mortgage loan, when using a TCO optimized mortgage structure (figures based on assumed sales price of $295,000). The second graphic reflects the number of households that a builder of "above code" homes could reach that a builder of "code built" or a seller of an existing resale property may miss due to qualifying limitations. These numbers are national in scale, so the number of households is rather large. We also generate these numbers for our clients on a state by state and 300 MSA basis as well (figures based on assumed sales price of $295,000 and a $10,000 increase for high-performance). Challenge #3 - Building and selling homes that are priced higher than your competition may be inviting appraisal challenges Using traditional mortgage strategies, this statement is 100% correct. However, we are not using a traditional strategy. Since high-performance homes are our specialty, we have developed proprietary strategies to address the appraisal issue before it happens and have proven success. And as an added bonus, when using our system, we keep a database of the info we need to support your appraisals going forward … a mortgage lender using traditional strategies will not have this data. So what about the $90,000,000? That’s easy and its simple mathematics. Using DR Horton’s 2017 Annual Report as a guide … the company closed 45,751 new homes in 2017 Their average sales price was $298,400 and their average Gross Profit / Homes Sales was 20.0% I've assumed that the increase in Sales Price to achieve a 40% increase in performance is 4.0%, this is $11,936, but to keep it simple, rounded it down to $10,000. (Just in case you like the math ... $298,400 * 4% = $11,936) If we apply the Gross Profit / Home Sales % to these incremental sales price dollars, our increase in Gross Profit per home = $2,000 (Just in case you like the math ... $10,000 * 20% = $2,000) And finally, if we multiply the new found incremental Gross Profit per home of $2,000 x 45,751 homes sold … we achieve a $91,500,000 annual increased Gross Profit / Home Sales All this, while saving their home-buyers approx. $49,900,000 per year in reduced TCO Amazing, huh? The name of this BLOG is Green Homes Matter … and based on these figures, I’d say that in the case of DR Horton … they sure do. Interested in seeing how using TCO can enhance your business, give Kerry a call (770) 365-7769 Take care, Kerry In closing, if you have any comments, please share them below And now to keep the lawyers happy ...

The Green Homes Matter Blog is owned by TCO Consulting, LLC. TCO Consulting, LLC is not a mortgage lender, it does not offer or provide mortgage financing of any type. This Blog is not an offer to extend credit. The numbers represented in this Blog are based on fact and we believe them to be 100% accurate, but your experience may be different than those illustrated. If you are in the market for a mortgage loan, we recommend that you obtain and review an official Loan Estimate from a duly licensed or registered mortgage lender. The Green Homes Matter Blog is written by Kerry M. Langley. Kerry is a nationally registered mortgage originator and is employed by United Community bank Mortgage Services in Atlanta, Ga,. His NMLS number is 506632. The comments, assumptions, assertions, illustrations and representations contained in this Blog are the property of TCO Consulting, LLC and do not reflect those of United Community Bank Mortgage Services. (c) Copyright 2018 - TCO Consulting, LLC ... all rights reserved

2 Comments

Ensign Building Solutions

3/12/2018 12:11:30 pm

Excellent article! Great organization of data to show that building energy efficient, or high performance, homes does make sense...even for a production builder. It'll take a bit of a paradigm shift and other innovative thinkers like Kerry to make this happen. Eventually, the entire home building industry (lenders, appraisers, realtors, etc.) will change.

Reply

9/11/2020 04:31:39 pm

I wrote about a similar issue, I give you the link to my site. <a href='https://www.deckbuildernewportbeach.com/' title='deck builders near me' target='_blank'>deck builders near me</a>

Reply

Leave a Reply. |

Kerry Langley (NMLS-506632) is the publisher of the Green Homes Matter BLOG, the developer of the mortgage optimization program - High Performance Lending (R), the creator of ProjectTCO and the owner of TCO Consulting, LLC.

Kerry is a thirty-three year veteran of the residential mortgage banking business and is employed by United Community Bank Mortgage Services. He specializes his business on developing innovative solutions so home buyers, existing home-owners, home sellers, real estate agents, home builders and financial advisors can enjoy the amazing benefits of Sustainable & High Performance Homes. CategoriesArchives

December 2018

Categories |

|

Contact:

Kerry M. Langley / HERS Associate - NMLS - # 506632 CEO / Founder / Managing Member TCO Consulting, LLC CEO / Founder / Managing Member The Home Buck$ Company, LLC kerry@greenhomesmatter.com kerry@thehomebuckscompany.com text/cell - 770-365-7769 |

The multi-colored circle graph combined with the stylized text "TCO" text is a registered trademark owned by TCO Consulting, LLC ... All rights reserved

Copyright 2023 - TCO Consulting, LLC ... All rights reserved

Copyright 2023 - The Home Buck$ Company, LLC ... All rights reserved

Copyright 2023 - TCO Consulting, LLC ... All rights reserved

Copyright 2023 - The Home Buck$ Company, LLC ... All rights reserved

RSS Feed

RSS Feed