The power of HERS rated / TCO Enhanced homes ... A case study: Unlocking the amazing "whole-house" value proposition of a High-Performance Home by combining a HERS 56 Home with TCO Optimized Financing

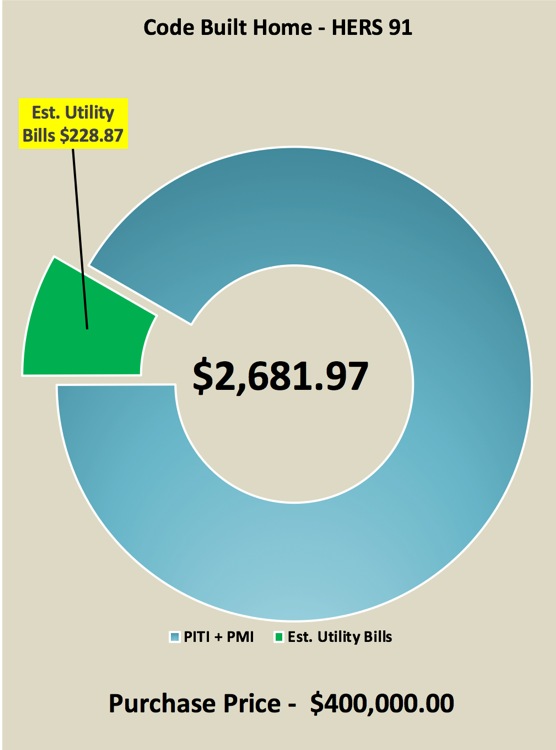

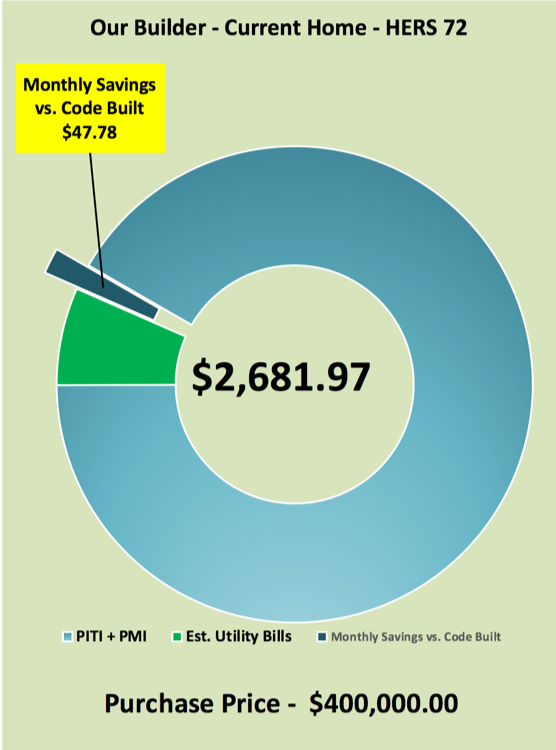

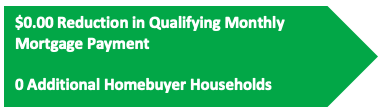

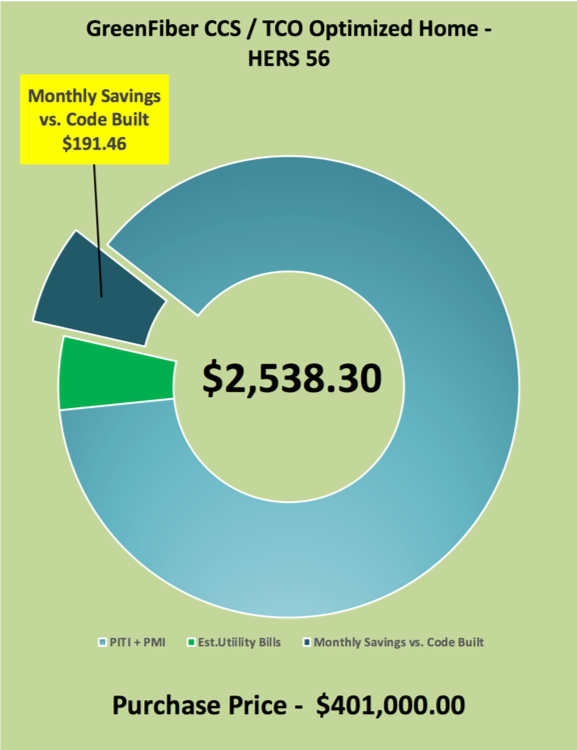

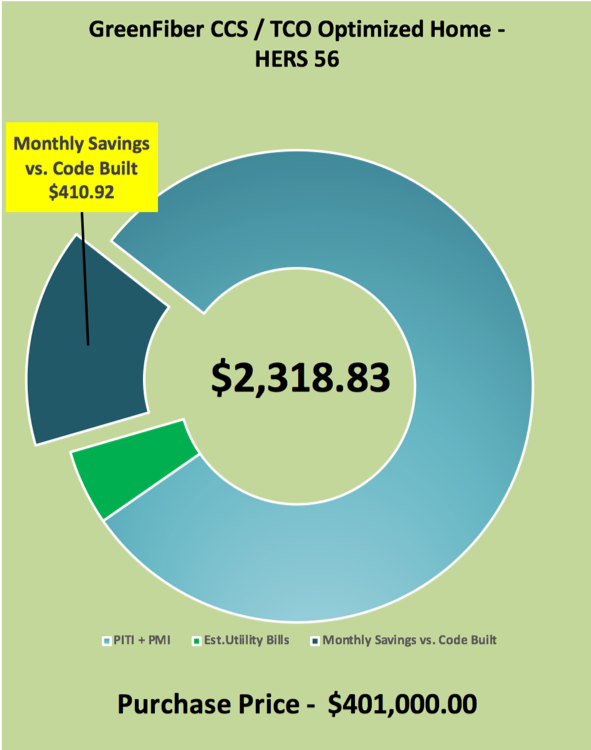

Why, because for 10 years I have been listening to advocates of the High-Performance Home industry bemoan the fact that the mortgage lending industry doesn’t get it. And they were right. Well folks here it is … we get it (or at least I do) and the numbers below prove it. And best of all, you can put this to all to work for you tomorrow!!! For those of you who may not know me, my name is Kerry Langley, I’m a 33 yr veteran of the mortgage banking business and for the last ten years I have been developing solutions to bridge the gap between the mortgage banking world and the high-performance home world. This work has led to the development of an excel based software program that is named “High Performance Lending®”, but that I generally refer to as TCO™ (Total Cost of Ownership). In a nut shell, the TCO™ program looks at the financial side of home ownership using a big picture, holistic approach (including Home Performance); much like a HERS raters looks at the total performance of the entire home/building. Along the way, I have presented programs at countless conferences (including RESNET, EBBA, and PassiveHaus). I have earned my HERS Associate certificate and had the opportunity to meet and work with tons of crazy smart folks (Ok, some are just crazy). I have recently been working with the totally awesome insulation pros at GreenFiber and you are going to love what we have come up with. Using my TCO™ software and some awesome building science/advance framing/insulation system/HVAC modeling from GreenFiber, I have recently added a new module to the TCO™ software. And the results, which I am excited to share with you in this article, confirms that Building Science, when supplemented with a powerful mortgage lending offer, will rock your world. Enough with all this narrative already, let’s look at the numbers … Step #1 – Getting Started … starting with a group of "specs" for a "Baseline House" The TCO™ software follows what could be called a “scientific process” that begins with calculating the costs figures for a control or “baseline house”. This set of calculations helps us set the stage to answer two very important questions (1) where we are starting? and (2) is the effort is worth our time? The energy performance illustrated in this baseline house is based on a HERS 91 (an estimate of a Code Built home in Atlanta, Ga) and the mortgage financing is traditional. Nothing exciting here … just a traditional house, built to code, financed with traditional financing, that could be owned by anyone. Sales Price - $400,000 - Est HERS Rating – HERS 91 Annual Energy Estimate - $2,746 - Down Payment – 10% Loan Term/Type - 30 yr fixed rate loan Baseline Interest Rate – 5.00% Taxes and Insurance - $5,200 APR (Annual Percentage Rate – 5.654% Qualifying Monthly Payment - $2,500.89 Step #2 – Looking at TCO™. As we move further into the TCO™ analysis, our next step is to crunch some numbers based on a typical home from a builder who builds in the Atlanta marketplace. Their current homes average a HERS 72 and they tell us that they are priced competitively with the “code folks”. Our goal in this phase is very straightforward … to determine the how much money owning a HERS 72 home will save a prospective home-buyer when compared to a code-built home. The graph below illustrates the Month #1 TCO™ of the HERS 72 home. And as expected, it does show a reduction in TCO™ due to reduced utility bills, coming in $47.48 lower than the Code Built home. One very important point to take note of … this is the value proposition that most builders of “Third Party Certified”, “EnergyStar” or “HERS 72” homes are making. They are building homes that are better than code and good for them. But by limiting their “value proposition” to saving their prospective home-buyers about $50/mo. due to improved home performance, the builder is missing a gigantic opportunity to deliver a much more powerful value proposition and reach a larger pool of prospective home-buyers than the code-built builders. Step #3 - Now, comes the beginning of the fun part. My building science buddies at GreenFiber have started working on a whole house modeling program to help builders enhance their homes’ performance with a very modest cash investment. In their initial study, they estimate that they can show our Atlanta builder how to transform their HERS 72 homes into a HERS 56 “rock-star” energy saving / money saving machines with a total incremental investment of approximately $1,000 … yep, I said $1,000 (pay attention here folks, this represents a 22% improvement in energy performance for very few dollars). Since, at this point, we are getting creative with the home performance for our Atlanta builder, this is also a good time to turn up the heat on the mortgage optimization to see what we can do to add additional punch to their value proposition. Our goal, targeting a further reduction of both the TCO™ and the underlying Qualifying Monthly Mortgage Payment, is to give our builder an added advantage over his/her code-built competition. And frankly, the results are amazing! As shown below, by optimizing the mortgage loan structure, we dropped the Month #1 TCO™ to $2,538.30 … a savings of $191.46 (vs. code-built). This gives our builder client an opportunity to offer their prospective buyers an innovative value proposition that will save them almost $2,400 each year. Pretty Amazing ...

So, now for the million-dollar question … |

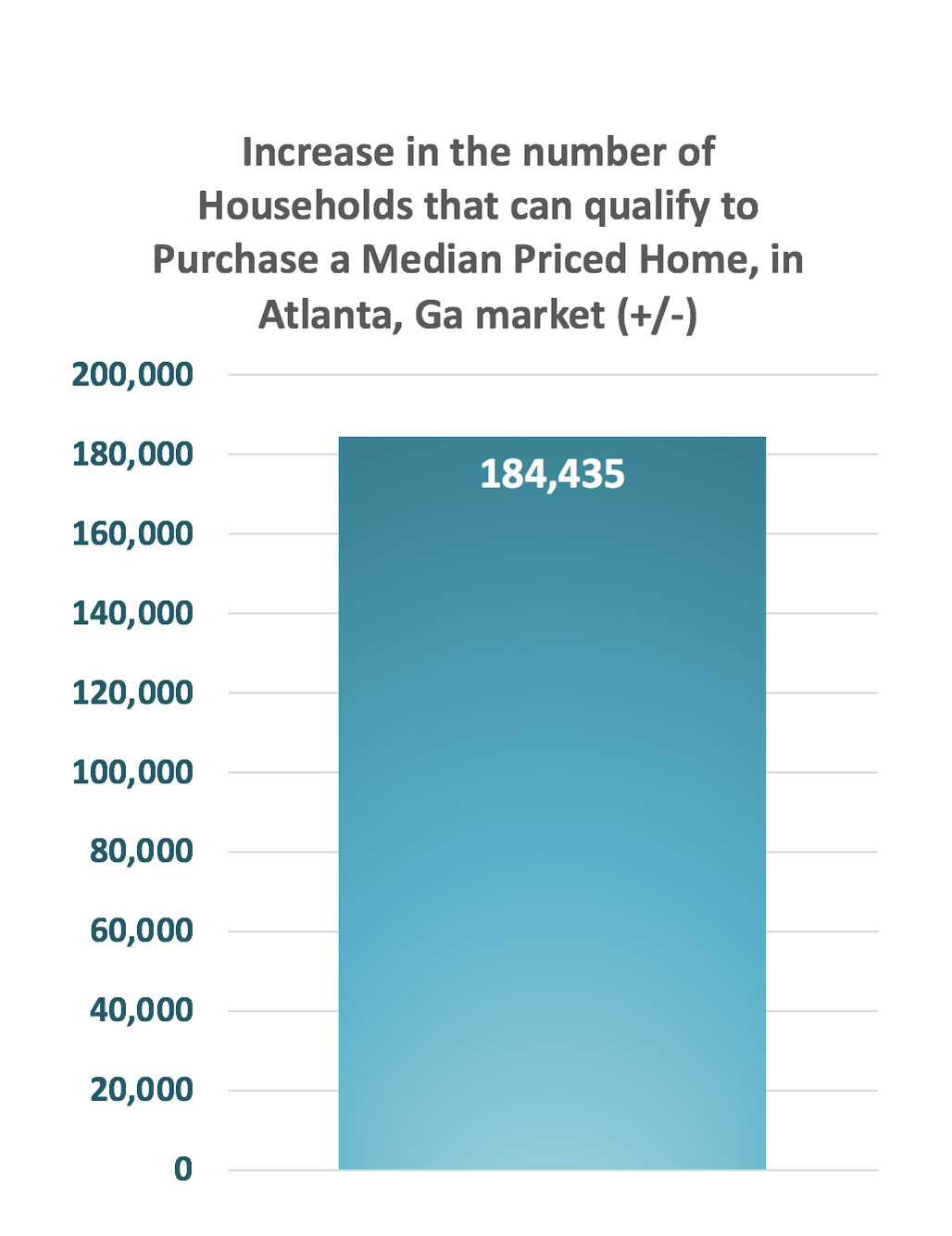

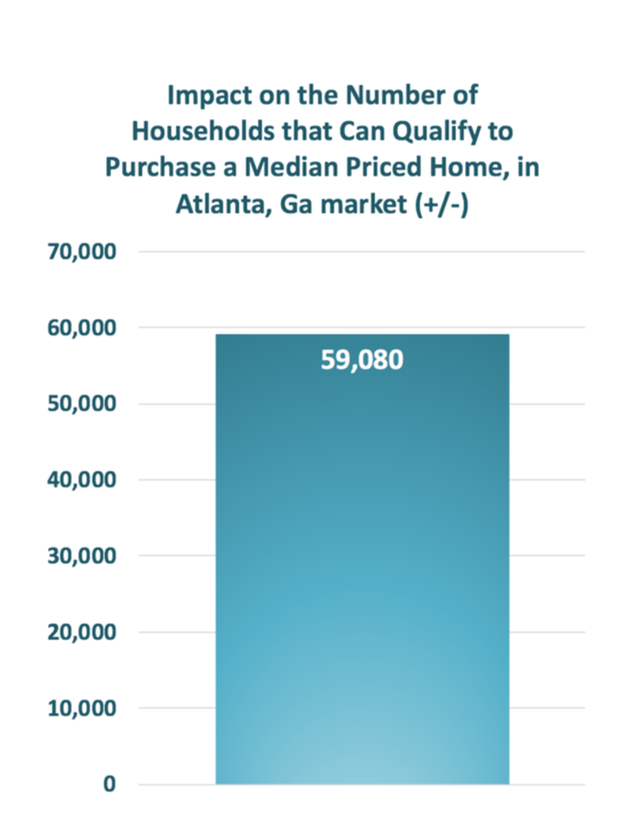

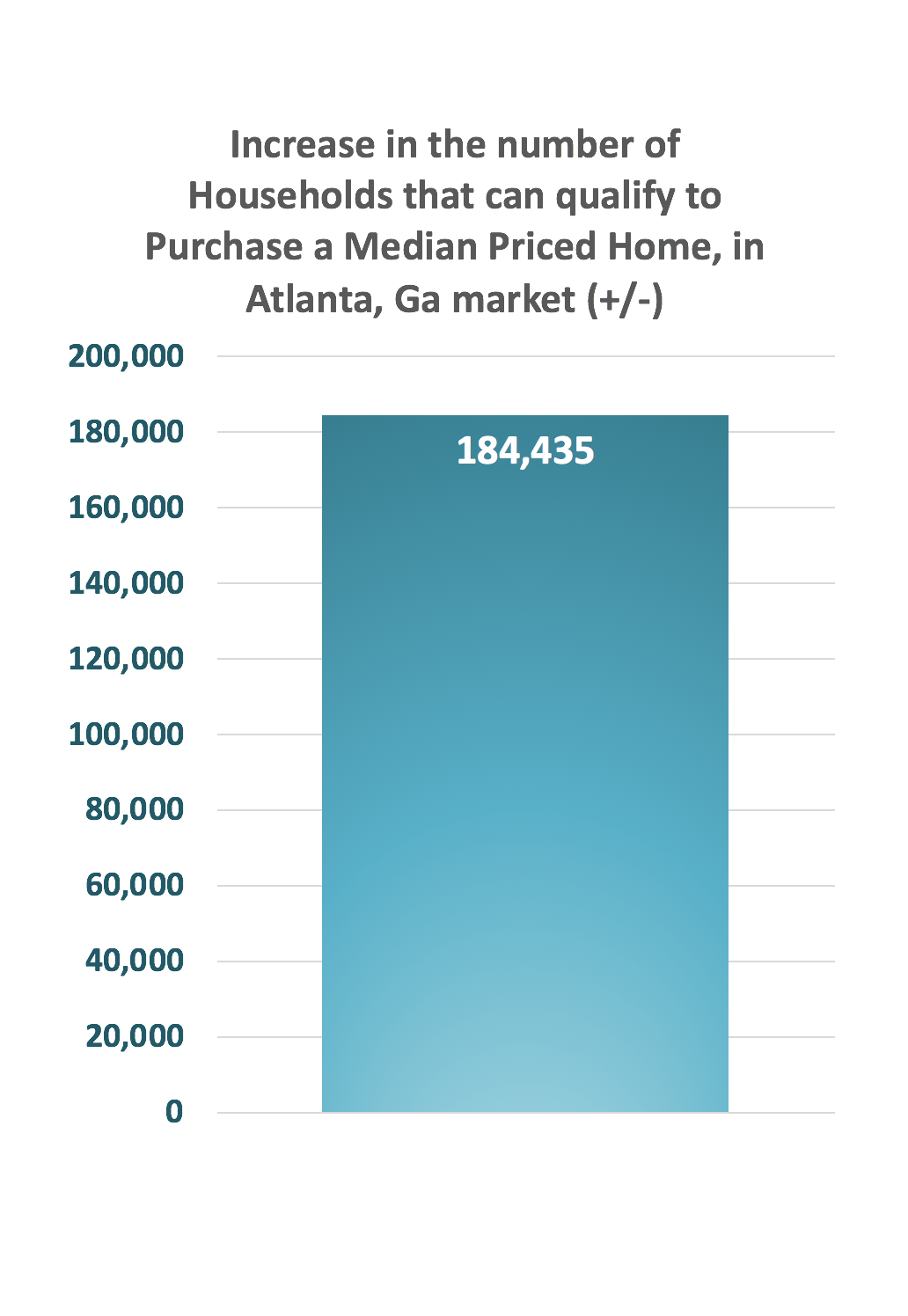

| And this is how we find the 184,000 new potential homebuyers for you to do business with. Now, I’m sure that someone out there is saying, “there is no way that I can deliver a new home builder 184,000 new buyers” … and you are 100% correct. That is not my point. Rather, what I am saying here is this … the market has changed … as a combination of upward trending interest rates and increases in building costs, nationally we have lost over 5 million prospective home-buyers. To combat this, most builders are going to squeeze pricing or cut back on standard features or pull back on buying or developing new lots … in other words, they are going to give their buyers “LESS”. I recommend that you give your buyers “MORE”. Consider positioning Energy Performance, Building Science and TCO Financial Optimization as a part of your standard business practice to help you sell more homes, at higher margins, to buyers that your competition can’t find. |

The high-performance home business is doing a good thing. Building homes that are better than they have to be is good for the environment, it’s good for construction workers, it’s good for home-buyers and it’s good for the neighborhoods where they are being built. It’s also a business risk to lead the pack. And the folks who are taking this risk should explore every opportunity to communicate the enhanced value proposition built into every home that they produce.

The numbers produced by this case study illustrate two very important things … (1) the opportunity for a home-builder to produce cost effective high-performance home is real and I encourage all home builders to explore it … and (2) over the past 10 years, I’ve heard countless leaders of the high-performance home industry call out the home mortgage industry for not developing a “green mortgage” … my hope is that the numbers shown above will address these concerns. Maybe we didn’t need a green loan after all, but rather, some creative thinking.

If you are interested in seeing how “thinking outside the box” can help you or your home builder clients, I’d love to discuss it further with you. Feel free to shoot me an email at [email protected] or call me on my cell @ 770-365-7769 (may be a good idea to text me first, I get lots of junk phone calls and my phone screens most of them).

The analysis contained in this article were generated using the “TCO-flex” module of the TCO™ - Total Cost of Ownership software program which was developed by Kerry M. Langley and is owned by TCO Consulting, LLC. Mr. Langley is a nationally registered Mortgage Loan Originator, NMLS -506632, and is employed by United Community Bank in Atlanta, Ga. The comments, illustrations and/or conclusions contained in this article are from it’s author Kerry M. Langley solely, and are not endorsed by the National Association of Home Builders, United Community Bank, Inc, or Greenfiber LLC.

The figures reflected in this presentation were generated for home building / real estate industry professionals only and are not an offer to extend credit. The figures were based on a hypothetical home purchase transaction with an assumed base purchase price of $400,000, a mortgage with a base loan amount of $360,000, a baseline interest rates of 5.00% for the 30 yr fixed rate loan and 3.99% for the 7-1 ARM, a loan term of 30 years, and estimated property taxes of $4,000 and home-owners insurance of $1,200 annually, standard PMI rates and an HERS Reference House estimated annual utility cost of $3,018. Consult a duly licensed or registered Mortgage Loan Originator for additional information on mortgage financing and always obtain an official Loan Estimate so you can compare fees and charges.

Apply GST registration online. One of our GST Experts will call you and clarify all your doubts. And then we will get your Online GST Registration done. We are no. 1 GST number online registration

cheap gst registration,charges for gst registration,gst registration filing,gst registration rate gst registration lowest price,gst number online registration,gst registration center chennai,gst registration in tamilnadu,apply gst registration online,gst registration agent near me,new gst registration fees,gst number registration charges,gst registration near me,gst registration fees in chennai,online gst registration in chennai,gst registration consultants in chennai,gst registration apply online,gst registration agent

Maxwell Global Software is No.1 mobile app development company in Qatar provides iPhone Apps, Android Apps, iOS Apps, Blackberry Apps, Windows Apps at affordable cost

gst return filing service online with MyGSTZone and to Apply Online GST contact our team to get easy & quick guidance how to apply in online.

Leave a Reply.

Kerry is a thirty-three year veteran of the residential mortgage banking business and is employed by United Community Bank Mortgage Services. He specializes his business on developing innovative solutions so home buyers, existing home-owners, home sellers, real estate agents, home builders and financial advisors can enjoy the amazing benefits of Sustainable & High Performance Homes.

Categories

Archives

December 2018

October 2018

March 2018

RSS Feed

RSS Feed